In FinTech, having an effective sales strategy early on is not important only for the future success of the business, but also for other activities such as raisinig investment

Lead generation and sales solutions for the FinTech industry

Industry challenges

The FinTech sector has experienced enormous growth in recent years. Despite this, FinTech businesses continue to struggle to sell effectively to banks and other financial institutions. These roadblocks range from regulations (impacting both banks and FinTechs), which create an environment in which it is hard to predict the course of events, to companies struggling to get noticed and considered for selection. One of the key reasons for this is the fact that banks have a completely different mindset to the dynamic and agile FinTech organizations. The risk-averse nature of selecting a vendor makes getting a foot in the door challenging. In contrast to other sectors that have allocated budget for testing innovative solutions and new vendors, banks tend to prefer household names with a record of success and credibility. As a new FinTech player entering the market, it can be difficult to measure up to these expectations. Cash-flow issues which stem from longer sales cycles can also make selling to banks difficult. To get the green light from a bank or a financial institution, a number of departments, teams, and key decision makers need to be on board supporting your solution and the changes your product will bring about.

How App Marketing Minds helps the FinTech sector

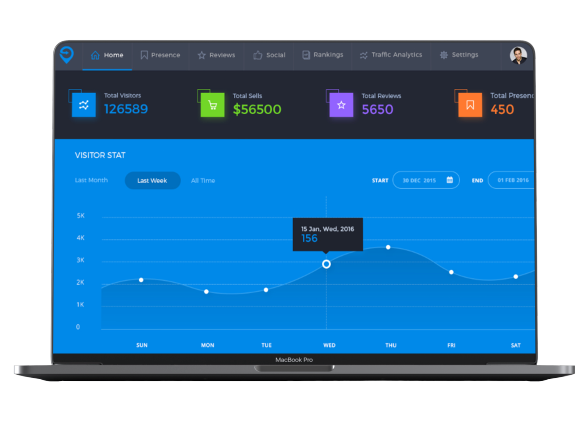

App Marketing Minds' outbound lead generation service can greatly mitigate a number of sales challenges faced by FinTechs. By offering an end-to-end lead generation service, we will start working on your market positioning and value proposition from day one, helping you to gain credibility despite not being an established market player. Secondly, App Marketing Minds' lead generation service takes a targeted, high-impact approach to generating demand for your product. Your sales efforts will experience a change whereby we will identify and research the most appropriate decision makers in identified target organizations. Each stakeholder is then approached with a personalised message and value propositions, completed with due diligence, research, and dynamic personalisation technology across various channels including, email cadences, social media flows, and paid media content. By implementing our cutting edge personalized and scalable approach, we are able to drastically increase the number of meetings secured with key decision makers, while decreasing your cost per leads and cost per meeting/demo.

''David is excellent with email campaigns, he managed in a short period of time to build the right messages and techniques with emails sent to our prospects. We had very good responses and with some of them an average reply rate of over 22%. David is good also with creating follow-up emails, structuring arguments, counterarguments, tailoring responses and sales materials, as well as creating negotiation techniques and strategies''

Wissem Souissi

CEO | diligend.com

Diligend is a one stop shop due diligence solution for banks and institutional investors

Watch a demo of our outbound lead generation process